I am going to say something that many of you will disagree with:

You should not base your marketing investment decisions off of cost per lead in the B2B space.

In fact, I think cost per lead is the worst metric you can look at as you build a service-based business.

Table of Contents

Why I dislike cost per lead

Cost per lead in the B2B space is at best a directional metric and at worst completely misleading.

As marketers, we like to look at raw numbers.

“I paid $100 and I got 50 leads! That’s amazing! $2 a lead!”

Great. How many of those actually closed into sales/clients?

“Well, I don’t know. That’s sales’ job. Sales qualified leads, right?”

WRONG.

Making your company money is your job whether you work in marketing, sales, ops, or HR.

And if you’re a marketer saying you’re getting a $2 CPL and sales is saying “We only closed one”, guess what your actual customer acquisition cost was?

$100. You spent $100, wasted your sales team’s time with 50 “leads”, and your company closed 1 deal.

If you go around touting that $2 CPL, you’re doing yourself a major disservice because you’re playing a different game. And that’s not a different game in a good way, but rather you’re playing softball while the rest of your company is playing chess, and you’re in a chess tournament not a softball game.

Can you tell I feel strongly about this stuff?

It all comes back to the ROI

If you’re selling leads to others on a CPL basis, then obviously you care about how much you spend to acquire that “lead” (put in quotes because getting an email and a name is not a qualified lead necessarily) because you’re also selling it for a specific number. You can’t pay $50 to acquire something that you’re selling for $29. That’s basic math.

But if you are getting new “leads” (I talk about projects on Credo, not leads) to grow your own service-based business, whether you’re a lawyer or a marketing agency, you need to be looking at how many of those closed and how much money you’re making/going to make from each.

Let’s look at this using a specific scenario:

- You pay $200 in a month and get 8 new potential projects

- You close half of those (4) at an average project value of $3000 per month

You’re billing $12,000 in new work now off of $200 in spend.

You could say “our cost per lead is $25!”

But if you look above, only half of those closed. So really, your cost per qualified lead is $50.

In this scenario though, you’re making a 60x return on your spend so you should just go take a nap on your bed of cash (or get to work delivering for those clients).

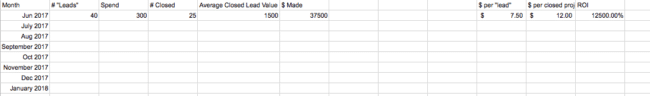

Hopefully you have a spreadsheet or something similar where you track this sort of information. It would look thus:

Also remember, this is just for that first month. Retain those, and holy crap you’re making amazing money.

Story time

At one point in Credo’s history (early to mid 2021), we were looking for a new marketing channel to really supplement our organic and referral marketing engine.

We carved out budget and hired an advertising agency. We increased our budgets on Google Ads and Facebook Ads and started tracking these metrics tightly.

Over time we found that Google Ads cost per lead is about $125 for a qualified lead (someone inquiring about finding a marketing agency). Our Facebook email lead cost is around $20.

Based on cost per lead alone, seems like Facebook is the winner right?

Wrong.

If you look closely, you’ll notice that Google Ads and Facebook Ads are both generating “leads”, but they are very different levels of qualified.

In fact, for every $1,000 I spend on Google Ads I get 6-8 qualified leads. But for every $1,000 I spend on Facebook Ads I get 50 email subscribers.

What we found was that for every 50 email leads we generated, we got 1 qualified project inquiry.

So “cost per lead” is $20, but cost per qualified lead (actively in the market to hire) was ~$1,000. That’s 6-8x higher than Google Ads!

Where CPL makes sense

As I said above, cost per lead (CPL) comes into play in a few scenarios:

- If you sell leads yourself;

- If you want to scale up your revenue faster than you scale your spend.

If you are currently paying $50 to acquire a new potential project and spending $500, you are getting 10 “leads” for your spend.

If you close half, you’re paying $100 per new client.

If you can drop that to $40 per, you’re now getting 12-13.

If you close half of the projects coming to you at an average monthly value of $1,500 and retain them for 3 months for an average project value of $4500, you’ve just made yourself at least an extra $4500 if not more each month for the same spend.

That’s pretty incredible, and absolutely worth doing. But only when it makes sense for your business.

What do you think?

If you run a marketing agency, do you watch cost-per-lead closely and make decisions off that? Or do you actually do the work to determine the ROI you’re getting?

And if you’re a business running ads, are you actually tracking if those “leads” are then turning into qualified leads and clients?

I’d personally rather pay $500 at a $100 per conversion rate that makes me $10,000 than $500 at a $10 conversion rate that only makes me $3,000.

Go for quality, not quantity.