“I’m going to start small and then if it works, I’m going to scale up.”

I’ll be honest with you. If I had $5 for every time I’ve heard this over the last half decade, I’d have a (much) nicer car than I do. And I’m a car guy.

The above statement is usually also lumped in with questions like “what’s the least I can invest to see a return?” and “Are there any guarantees?”

As we all know, there are only two guarantees in life. And a quick positive return on a minimal marketing investment is definitely not one of them.

When given the opportunity, I’ll try to dig a bit deeper into the mindset of the person asking these questions. What people believe is fascinating to me, and it turns out being curious about your potential customers is a great way to build a business.

Usually when poking deeper, we hear terms like “test” and “not sure if”. When I then ask how they’ll know it’s working even if it is, they usually don’t have a good answer. When I ask how they’re measuring, they usually aren’t.

While it may be true that people with this mindset are unqualified to be a customer, I also think that some education can go a long way.

Reality is, there is very real risk of underfunding your marketing.

A lot of people are afraid of overfunding their marketing and not seeing as good of a return as they could, but not enough are afraid of underfunding their marketing and therefore not giving it a chance to succeed.

Not enough people are afraid of underfunding their marketing.

At the end of the day, a lot of people are too focused on the wrong specific metrics (“ROI”, “ROAS”, “CAC”, “Domain Authority”) and not focused enough on the metrics that matter – revenue and profit.

Because I want to be helpful, I’ve been asking around a lot to see what percentage of revenues other marketers think someone should be investing into marketing based on how aggressive they are being.

Of course, take all of this as directional and guidelines, not hard and fast rules.

Here are the guidelines I’ve arrived at for how much of your revenue, as a percentage, you should be spending on acquisition marketing based off how much you are looking to grow:

- Maintaining revenue – 2-4% of revenue

- Growing slowly (5-10% a month) – 5-20% of revenue

- Growing aggressively (20%+) – 20%+ of revenue

Table of Contents

How to know how much to invest in marketing

There is a relatively simple way to know how much you need to invest in marketing each month to hit your revenue and growth goals.

You need to know the following:

- your growth goal

- how much it costs you to acquire a new customer (by channel, if applicable)

- how much that customer is worth to you

- how many customers churn per month (if SaaS or a service business) and what that costs you on average (revenue churn, not logo churn)

From there, you can begin to build your marketing budget as seen below.

Maintaining revenue (and profit)

Businesses have customer churn, and some more than others. If you’re an ecommerce business then your customers are likely shopping on your site once to a few times per year. If you’re a SaaS business, then you’re probably experiencing ~3-7% of your customer base churning per month (less if you’re good, higher if you’re struggling).

This means that in order to maintain your growth trajectory you have to keep adding new customers every month just to make up for the ones that either stop buying or cancel their subscription. If you have 100 customers and 5% churn, you need to add 5 new customers every month just to stay even, and 6 to grow a bit (in this case, 1% month on month).

At the same time, you need to remember that inflation exists and that business costs always go up. People need raises, vendors raise their prices, goods get more expensive. If you factor in 3% annual inflation, this means you need to grow at least 3% just to keep up with rising costs.

This usually means spending at least 2-4% of your monthly (and thus annual) revenue on acquisition (new customer) marketing.

Let’s think about it this way.

Say you’re a SaaS company charging $100/month for your tool. You have 100 customers and 3% monthly churn (super low).

You’re just getting started, but you’re at $10k MRR/$120k ARR churning out $300 MRR every month. Your CAC is $150.

You need to spend $450 to acquire 3 customers. This means you’re spending 4.5% of your monthly revenue to keep your revenue flat.

It is impossible to know how much you need to spend to maintain or grow revenue if you don’t know your acquisition costs.

Growing slowly

If you want to grow each month but aren’t being super aggressive with your growth goals, then you will likely spend somewhere from 4-15% of your revenue on average and maybe more.

Once again, you need to understand your acquisition costs so that you can properly apply budget.

Let’s keep the same example from above going. You’re a SaaS company with 100 customers at $100 per month. You’re churning 3% each month but want to grow to 300 customers in the next 12 months.

This means you need to add 200 customers at a $150 CAC each. This means you need to spend $30,000 on marketing over the next 12 months, or an average of $2,500 per month, right?

But wait. You’re still churning out 3% of your customers every month.

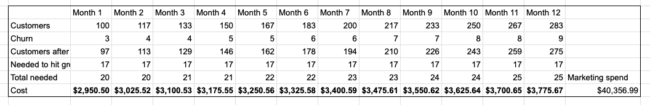

So here’s how the math works out:

As you can see, without understanding your CAC and your churn and doing the math properly you would have under-resourced your budget by $10k, almost 1/3!

Using the above numbers, you need to spend $40,356 per year. At the start you’re spending 29.51% of your monthly revenue on marketing ($10k in revenue, $2,950 in marketing).

By the 12th month, this percentage is down to 13.32% and shrinking every month. But revenue has now climbed to $28,337.00, which is almost a 3x increase from where they started. That’s pretty great.

This company did $230k in revenue across the year and spent $40,356 which means they spent 17.54% of their revenue on marketing to 3x their customer base and revenue.

This is why we say that marketing is an investment and you have to give it time to work as well as understanding your metrics.

Growing aggressively

Finally, there are the aggressive growth companies who are going to invest even more of their monthly revenue into marketing in an attempt to grow even faster.

Aggressive growth companies will often spend anywhere from 25-50% of their revenue, if not more, to grow fast. This is often not possible for bootstrapped companies, so when you’re looking for rapid growth like this it usually makes sense to already understand your numbers and to then go raise funding in order to grow and gobble up marketshare. Profitability is not a concern in this case.

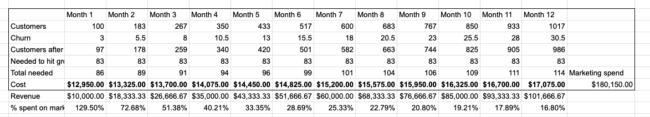

Still using the same example above of 100 customers at $100 each and a $150 CAC, let’s say they want to grow to 1,000 customers which would put them at about a $100k MRR/$1.2M ARR rate after 12 months. This might even still be considered “good growth” by the way, but let’s run the numbers.

Using the above numbers, this company will need to spend $180,150 on marketing across the year. At the start they’re spending 129.50% of their monthly revenue on marketing ($10k in revenue, $12,950 in marketing).

By the 12th month, this percentage is down to 16.80%% and shrinking every month. But revenue has now climbed to $$101,666.67, which is over a 10x increase from where they started. That’s pretty great.

This company did $670k in revenue across the 12 months and spent $180,150 which means they overall spent 26.89% of their revenue on marketing. As I said above, this could even be considered still “good growth” and not hyper growth, even at 10x’ing their number of customers and revenue!

As you can see, in order to know how to properly budget for marketing you need to know a few things:

- Your goal for growth

- Your customer acquisition cost

- Your customer churn or average order size

From there, you can run these exercises to know how much you need to spend (and invest) to have a chance at hitting your numbers.